Securing a personal loan can feel like navigating a maze of requirements and thresholds. Yet, with the right insights, you can align your profile to what lenders truly value and boost your chances of approval.

Every lender evaluates applicants through a combination of quantitative metrics and qualitative judgments. While interest rates and repayment terms may vary, the core approval factors remain consistent across most institutions.

By understanding these benchmarks, you can target areas for improvement and present an application that stands out for its clarity and completeness.

Your credit score often provides the first impression to lenders. It reflects your past behavior and indicates future risk. Typically, a minimum credit score of 580 can unlock basic personal loan offers, but the most favorable terms go to those in the 640–700+ range.

Most lenders examine your entire credit history, focusing heavily on payment history (which accounts for roughly 35% of a FICO score), credit utilization, the mix of accounts, and recent inquiries.

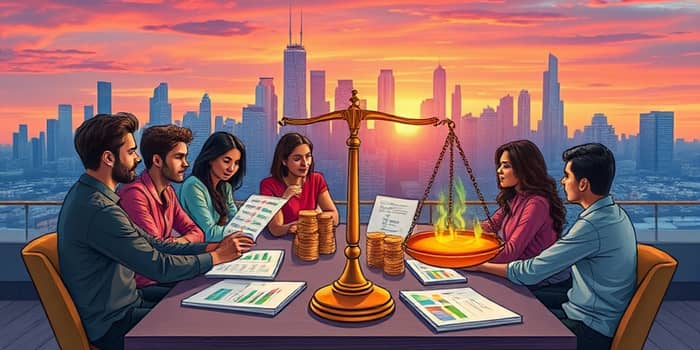

The debt-to-income (DTI) ratio measures how much of your monthly gross income goes toward debt payments. It’s calculated as:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

A DTI below 36% is ideal, though some lenders may extend up to 50% for strong applicants. A lower DTI demonstrates responsible debt management and assures lenders of your capacity to repay a new obligation.

Lenders require concrete evidence of your ability to repay. This means providing up-to-date, verifiable documentation. Having everything organized not only speeds up approval but also signals professionalism and preparedness.

Applicants with higher and consistent income streams often qualify for larger loan amounts and lower interest rates. In contrast, gaps or irregularities can lead to tighter scrutiny or conditional approvals.

While most personal loans are unsecured, some lenders offer secured options that require assets—such as savings accounts, vehicles, or property—as collateral. Offering collateral can:

However, keep in mind that defaulting on a secured loan can put your assets at risk. Always weigh the benefits against potential downsides.

Beyond the headline metrics, lenders may assess additional elements of your financial profile. These include:

These factors help lenders gauge your overall reliability and reduce the perceived risk of lending to you.

If you’re not quite at the ideal benchmarks, there are clear steps you can take to improve your standing before applying:

These proactive measures can make a noticeable difference in the rates and terms you’re offered.

Lender requirements can vary widely between traditional banks, credit unions, and online platforms. Banks often require higher credit scores and may take longer to process applications, while online lenders might be more flexible but charge higher rates.

Compare multiple offers, paying close attention to annual percentage rates, origination fees, repayment terms, and customer service reputations. Aligning your specific profile to the lender’s preferences can unlock the best possible deal.

Securing a personal loan need not be an opaque process. By focusing on credit score, DTI ratio, verifiable income, and loan purpose, you position yourself as a low-risk borrower. Remember: preparation and transparency are as vital as the raw numbers.

With a clear strategy and an understanding of what lenders look for, you can confidently pursue the funds you need—whether it’s for debt consolidation, a home project, or an unexpected expense.

References